Results to date

How has SMTP performed so far? The SMTP software is designed as both an algorithm development module and a trading platform. Both run simultaneously in the same Excel files. Their success is measured in different ways.

SMTP Trading Performance

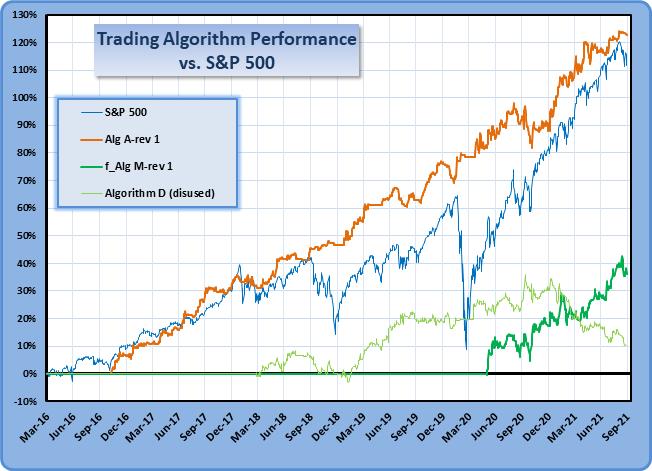

Two algorithms have been selected for trading from the 1000+ under evaluation. Returns from these two algorithms are compared to benchmarks in the graph below. Note the performance during the recent Covid 19 downturn - both algos remained 100% cash during much of the crash and did not suffer the losses that most market indices did.

Notes on the graph

- Algorithm D is SMTPs' best performer in since evaluation began. It outperforms the S&P 500 by>60% since inception, and is approaching top 1% ETF performance.

- Alg- A rev 1 shows lower return than Algorithm D but is currently demonstrating very low drawdown (4.4%) and is outperforming the S&P 500 by approx 40% since it began evaluation in Oct 2016. Note the steady, linear gains it delivers, regardless of market conditions.

- S&P 500 returns are based on index data. The SPY ETF includes reinvested dividends and is approx 10% higher.

- Warren Buffett performance measured using Berkshire "A" shares.

- SKYY (a Cloud Computing ETF) ranks approx 20th out of a total of 2031 non-leveraged ETFs in the past five years . It is used here to illustrate the performance level required to be in the top 1% of US ETFs over this period.

SMTP Algorithm Development Performance

Development of improved algorithms depends on experimental observations from current ones. Adjustments made based on these observations must deliver quantifiable improvements if the development process is to be considered successful. To verify this, a project management status tracking from Engineering is used. There is too much detail in it to cover here, but the success or failure of each "project" is indicated in the blue box.